Hdfc Forex Card Atm Withdrawal Fees

Tom Lohr is a futurist and hates cleaning. He is still waiting for his flying car.

Photo by Mirza Babic o

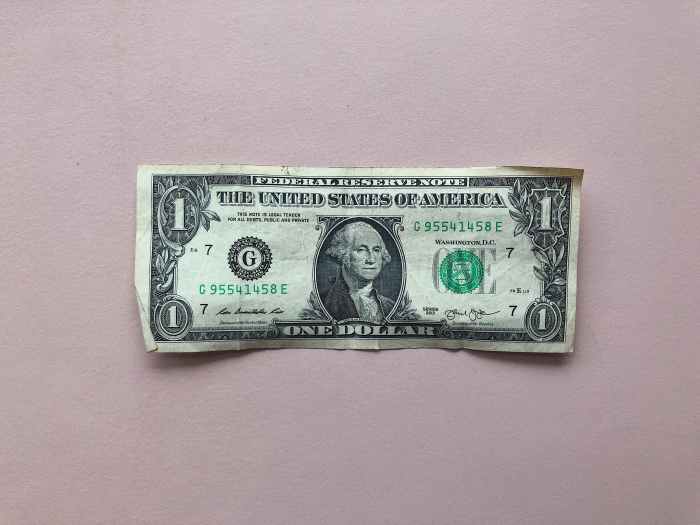

It's Your Money

You work hard for your money. Each dollar you earn you are trading moments of your life for, and if there is one thing that is limited for everyone, it is time. Unfortunately, there is always someone or something that wants a taste of your cash. Before you even get your pay, it is overly taxed by federal, state and local governments. What's left, if can squirrel away a portion into your savings account, that money that is already taxed can earn you a small return. That interest that your money earn is also taxed. So naturally, after being taxed to death, you would think that you would have free access to your wages, only to find out that if you try to get a little spending cash from an automated teller machine (ATM), you are often be charged a fee for getting some of your own funds. It never stops, the sharks are always circling your money.

There isn't much you can do about your taxes, they will always be coming for more and more of your money. But you can ease the pain of getting your own, hard earned cash into your hands by avoiding paying ATM fees. If you love keeping your money, those fees can add up to a considerable sum. The national average fee for withdrawing money from an ATM is $4.64. If you hit the ATM once a week, that will end up costing you $241.28 a year. That would pay for 6 months of my internet bill.

So how can you reduce or eliminate the sting of ATM withdraws? A little fiscal discipline will go a long way keeping your dollars in your pocket. Here are five simple ways to avoid or reduce ATM fees.

Photo by Ryan Quintal

1. Withdraw Additional Cash

Need $100 from your account? Take $300 or more the next time you use the ATM. Better yet, get enough cash to last the month if your bank allows that much to be withdrawn. Use that cash until it runs out and you will cut out several of your ATM trips per month. Put that cash away somewhere. Don't carry all of it on you. Keep it in a discrete place in your home and be your own ATM once in a while.

Photo by Avery Evans on

2. Use a Debit Card

Safer than cash, a debit card acts like a credit card, but only allows you to use cash that is actually in your account. If you use a debit card exclusively, you are basically operating in a cashless mode. No cash, no ATM fees. You probably still want to carry a small amount of cash for those few places that don't accept any type of card. If you use the fist suggestion and withdraw extra cash, you might be able to make that wad last all year if you use your debit card religiously.

3. Get Extra Cash When Paying

Speaking of debit cards, many places will allow you to get extra cash when paying with one. It's like using an ATM, operated by a human, without the fees. Not all places will do this without a charge, so ask about fees before getting extra cash when paying with a debit card.

Photo by Eduardo Soar

4. Use Only In-Network ATMs

Most banks and credit unions do not charge a fee if you use an ATM at one of their branches. This is a good choice if your bank has branches conveniently located near you. Most bank apps will show you the locations of their ATMs. If you bank with a national chain, then it can allow you fee-free access when traveling. If you bank at a local credit union with only a few locations, you should look into a debit card.

Photo by Christian Wiedige

5. Use Your Bank's App

Sadly, many ATMs will charge a fee for any business conducted. Want to check a balance or transfer funds between accounts? You can do it on some ATMs...for a price. More than likely your bank has an app that you can download, allowing you to do the same things from your phone, without the fees.

Bonus Tip: Ask Your Bank About Reimbursements

A few select banks will reimburse you for fees paid at ATMs. While those institutions are few and far between, they do exist. Ask your bank about fee reimbursement.

Photo by Etienne Martin

Don't Feed the Sharks

Living in the 21st century was supposed to be awesome. In some ways it is. If you did banking before the advent of ATMs, getting your cash meant walking into an actual bank building was only open 9-5. ATMs made that hassle a relic of the past. Now, in the futuristic (it was supposed to be, ask anyone born before 1980) present, we have machines that can give us cash 24/7. The only difference? Those brick and mortar banks never asked for money for handing over your money.

Hdfc Forex Card Atm Withdrawal Fees

Source: https://toughnickel.com/personal-finance/How-to-Avoid-or-Reduce-ATM-Fees

0 Response to "Hdfc Forex Card Atm Withdrawal Fees"

Post a Comment